Sentinel Companies: How to Identify, Track & Profit From Businesses that Anticipate New Market Trends

A note on harnessing environmental science to apply early warning indicators in financial markets

During the early 20th century, coal miners faced a silent, invisible threat every time they descended into the depths of the earth: toxic gases. Odorless killers like carbon monoxide could build up in mine shafts, often with fatal consequences. The solution? A small, yellow songbird - the canary.1

Coal miners would carry caged canaries into the mines with them. These birds, with their rapid breathing rate, efficient respiratory systems, and high sensitivity to airborne toxins, would react to dangerous gas levels long before humans could detect them. If the canary stopped singing, fell off its perch, or worse, died, it was a clear signal for miners to evacuate immediately.

This practice - the use of a sensitive species as an early warning system -not only saved countless miners' lives but also gave birth to a powerful concept in environmental science and to, nowadays, to hundreds of financial media headlines.

Across our planet's ecosystems, nature has developed sophisticated early warning systems:

A sudden decline in frog populations might signal environmental stress long before other species show signs of distress.

Bees play a vital role in pollinating crops and wild plants. A decline in bee populations signals threats to biodiversity and food security.

Coral reefs are highly sensitive to changes in ocean temperature, acidity, and pollution. Their decline can signal broader threats to marine ecosystems and fisheries.

These biological indicators serve as nature's sentinels, providing early alerts to changes in their environment. You get the idea.

Now, part of Polymath Investor's goal is to apply insights from various disciplines to enhance our understanding of markets and become better investors.

So, what can we learn from this interesting approach within environmental science?

Just as natural ecosystems are intricate webs of interdependent species and environmental factors, so too are financial markets complex networks of interrelated companies, sectors, and economic conditions.

Like organisms in nature, companies don't exist in isolation. They interact, compete, and depend on one another, creating a dynamic and constantly evolving system.

What I’m proposing here, is that every time we approach a new company, we frame our thinking with an ecosystem mental model, studying the cluster of companies and their interdependencies as much as the target company itself.

In this article, I'll explore how the concept of sentinel species can be applied to the equity research process. I will discuss how these early indicators can help us anticipate related company performance and broader trend changes in the market as a whole.

An Investor's Edge: How to Identify Companies with Predictive Power

What’s our goal here? We want to find companies that are sensitive to market trends or changes in the sector we are analyzing, and we also want companies that provide a true signal, we want as much predictive power as possible.

So, let's explore what types of companies exhibit these characteristics.

1) The Canary in the Supply Chain: How Upstream Companies Can Predict Market Waves

The first and most obvious source of companies with predictive power is businesses at the beginning of the supply chain.

These companies often serve as great sentinel indicators, as they tend to experience changes in demand or market conditions before these shifts propagate through the entire supply chain.

Below, I provide a table outlining how to identify and analyze these types of companies.

Hexcel as a Sentinel for the Plane Manufacturing Industry

Hexcel is a key supplier of advanced composite materials used in aircraft manufacturing. These materials are crucial for building lighter, more fuel-efficient planes, and are increasingly used in both commercial and defence aerospace applications.

As aircraft manufacturers ramp up or slow down production, their demand for Hexcel's composite materials will likely change accordingly.

You just have to read Q1 2021 earning’s call transcript to asses what was happening in the industry. From the CEO:

“Thanks, Patrick. Good morning, everyone, and thank you for joining us today as we share our first quarter results. These numbers reflect the beginning of what we expect will be a gradual and steady recovery over the coming quarters as the world emerges from the economic effects of the pandemic and regained its confidence in air travel once again” -Nick Stanage

“Our first quarter results give us confidence in our outlook for a steady recovery throughout 2021. “ -Nick Stanage

Sure enough, Boeing and Airbus reported their highest percentage increase in sales in the following quarter, marking a record for the past decade.

So, what Hexcel's metrics would be interesting to track?

Order backlog: A growing order backlog suggests strong future demand for Hexcel's products and a positive outlook for the aerospace industry.

Revenue growth: Strong revenue growth, especially in key aerospace segments, can indicate healthy industry expansion.

Management commentary as we did above: Hexcel's management executives often provide insights into aerospace industry trends and customer demand during earnings calls and investor presentations.

Of course, it's important to combine the analysis of Hexcel's performance with other economic indicators and industry-specific data. No single company can perfectly predict the future, but Hexcel's unique position in the supply chain makes it a valuable tool for anticipating potential shifts in the aerospace and related industries.

2) The Market's Pulse: Companies with a Finger on Multiple Industries

Companies serving a wide range of customers across various industries could also act as good sentinel indicators. Their broad exposure allows them to detect shifting demand patterns early, before these changes become apparent in more specialized firms or the broader market.2

So, how do we work with this companies? Let’s see:

Meta Platforms as Sentinel Company for Alphabet

Meta's advertising platform serves a vast array of businesses across various industries. It provides a broad view of advertising spending trends and consumer engagement across different sectors.

By analyzing Meta's ad revenue growth, engagement metrics, and advertiser commentary, you could potentially glean insights into the performance of other companies that rely on advertising and consumer spending, like Alphabet.

Their earnings reports are typically released within a few days of each other, providing an early indication of the digital advertising ecosystem's health simply by analyzing their results.

If you take the sales actual vs sales estimate surprise as a %, you can see that the correlation is not that bad:

Analyst are surely calibrating their estimates between this two companies.

As always, while Meta's performance can offer good insights, remember that correlation doesn't equal causation. Alphabet’s performance can be influenced by other factors besides overall ad spending trends, such as its own product innovations, user growth, and competition.

3) Market's Sprinters: Companies That React First

Companies with short operating cycles can also serve as good sentinel indicators because they can quickly reflect changing market conditions. Their rapid turnover in inventory, receivables, and payables allows them to adapt swiftly to market shifts, making their performance a leading indicator of broader economic trends.

A company with long operating cycles is like a transatlantic ship—it takes time to turn.

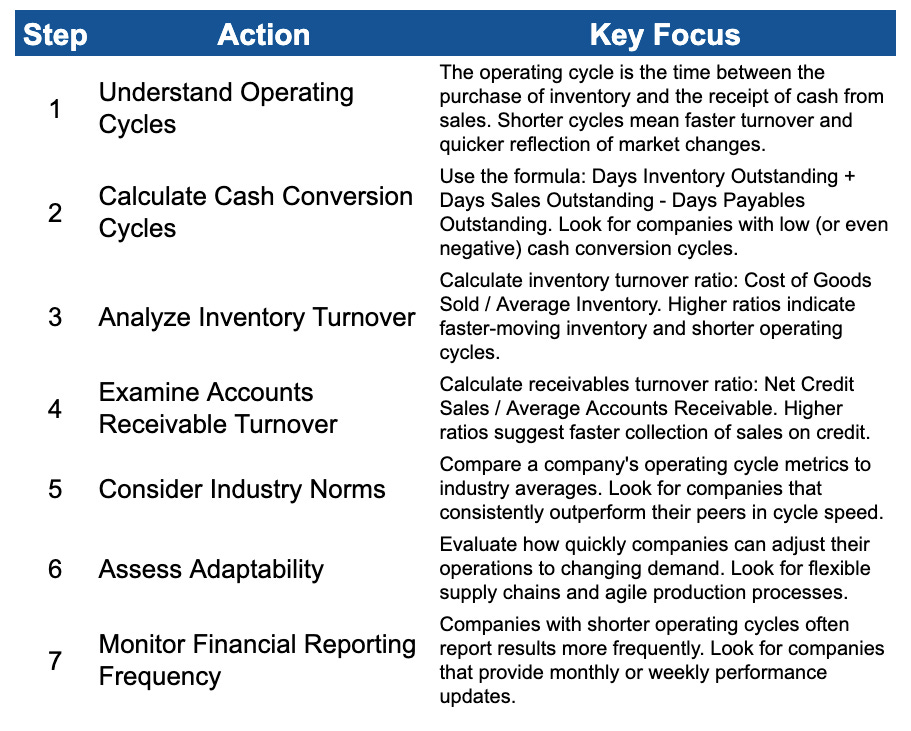

As I did above, here are the main considerations when working with these companies:

C.H. Robinson as a Sentinel Company for Global Trade

Let's see how C.H. Robinson Worldwide, Inc. (CHRW) shows the characteristics of a sentinel company with a short operating cycle, and how this positions it to provide early signals of global trade trends:

C.H. Robinson primarily acts as a freight broker, connecting shippers with carriers. It doesn't own a large fleet of trucks or other physical assets. This means its operating cycle is not tied to the depreciation or maintenance of those assets.

CHRW can react quickly to changes in demand, scaling its operations up or down without the burden of managing a large asset base. This agility allows them to mirror shifts in global trade volumes almost in real-time.

A sharp increase in revenue would suggest a rise in shipping volumes, indicating a healthy global trade environment. This could be a positive sign for economies reliant on exports and imports, and for companies involved in manufacturing, logistics, and retail.

By monitoring these companies and others with similarly short operating cycles, you can gain early insights into changing market conditions. These companies can quickly adjust their operations in response to shifts in demand, making their performance a leading indicator of broader economic trends. The key here, I think, is to look for companies that not only have short cycles on paper but also demonstrate the ability to rapidly adapt to changing conditions in practice.

4) The Cyclicals: Companies that Anticipate Market Shifts

Companies in cyclical industries can serve as sentinel indicators because their performance is closely tied to economic cycles. Generally, these companies tend to be more sensitive to changes in economic conditions, many times experiencing amplified effects of economic expansions and contractions.3

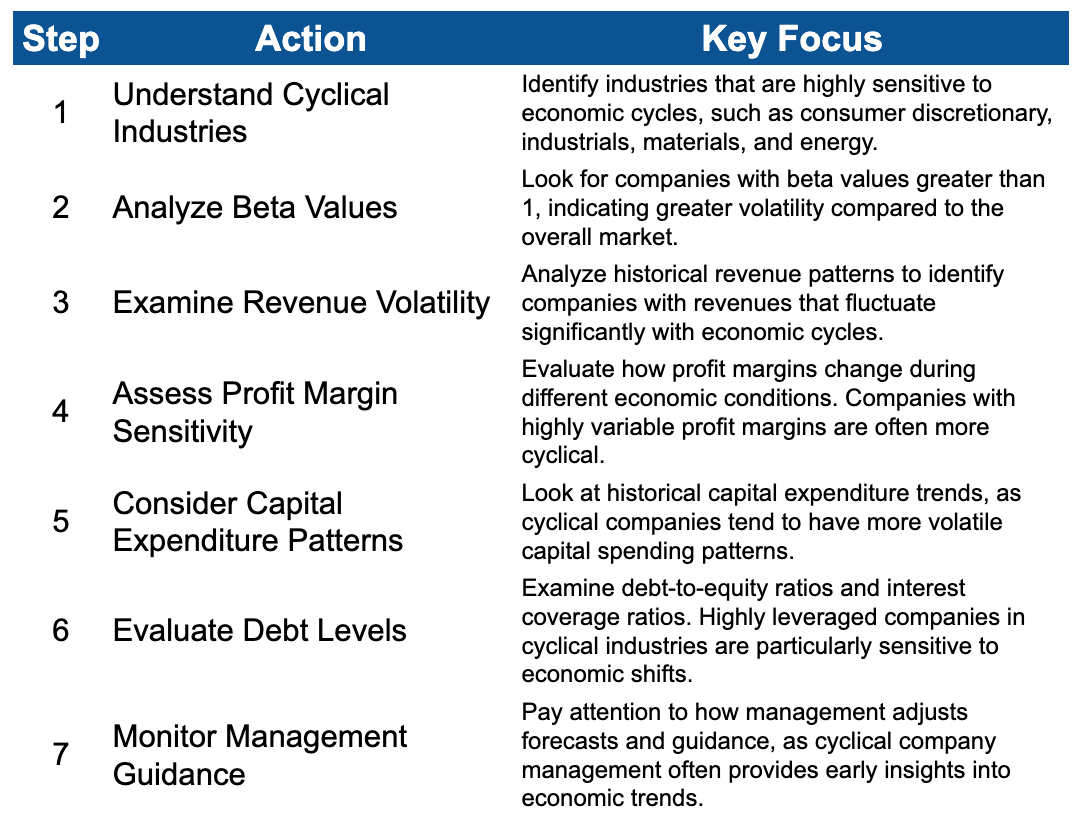

A summary of key actions to take below:

Watsco as a Sentinel for Construction & Home Improvement

Watsco is a leading distributor of HVAC (heating, ventilation, and air conditioning) and refrigeration equipment. Their performance is closely linked to both new construction projects (requiring initial HVAC installations) and the replacement/upgrade market in existing buildings.

Watsco's sales, earnings, and inventory levels can offer early insights into these areas:

New Construction Activity: Increased sales of HVAC equipment, particularly for residential and commercial construction projects, can signal a robust construction market. This could benefit construction companies, building material suppliers, and other related industries.

Home Improvement & Renovation Spending: Higher sales in the replacement market, driven by upgrades or repairs of existing HVAC systems, could indicate strong consumer confidence and spending on home improvement projects. This could positively impact home improvement retailers, appliance manufacturers, and contractors.

So, which metrics should you watch?

Sales Growth: Track the overall sales growth, as well as growth in specific segments like residential new construction, commercial construction, and replacement markets.

Inventory Levels: Rising inventory levels might suggest slowing demand, while decreasing inventory could indicate strong sales and potential supply constraints. A quick look at this can reveal two things: first, the correlation between sales and the construction index; and second, how a decrease in inventory days outstanding anticipates an uptrend in the general index.

Management Commentary: as always, Watsco's management team can provides insights into market trends, customer behavior, and the overall outlook for construction and home improvement spending during earnings calls and investor presentations.

5) The Alpha in the Pack: Tracking Market Leaders

Industry leaders are typically the first to experience and respond to changes in their sector. Their scale, market position, and resources allow them to detect and react to industry trends before smaller competitors.

When tracking market leaders, I would prioritize the qualitative aspects, such as analyzing the technologies they're investing in, the markets and segments they're targeting, etc., to gain insights into future trends. This approach is more valuable than simply monitoring changes or surprises in revenue levels.

SharkNinja as a Sentinel in the Home Appliance Industry

SharkNinja has established itself as a leading innovator in the home appliance industry. Their success is largely attributed to their focus on developing and marketing products that address unmet consumer needs, often incorporating cutting-edge technology and design.

By closely monitoring the categories and technologies that SharkNinja is investing in, you can gain tremendous insights into the future direction of the home appliance market. Their CEO, Mark Barrocas, talk about new category launches almost every quarter.

This is from Q1 2024:

“So look, I'll start off by saying that in the quarter, we're really excited about the 2 new category launches that we've gone into. The Ninja FrostVault is our first launch in the cooler category. That product launched just a couple of weeks ago and has actually been a complete sellout.

We're out of inventory completely right now on that product. So we'll talk a little bit more about outdoor. And then secondly was the Shark FlexBreeze fan, which has been a really nice success for us in just a short few weeks and especially as the weather is warming up in most of the country right now.” -Mark Barrocas

Just take a look at SN highly developed R&D department and their complex network of suppliers. Their R&D investments and partnerships can highlight emerging technologies and features likely to become mainstream. Look at their R&D spending - it's ramping up rapidly.

Searching for Golden Nuggets When the C-Suite Speaks

Another valuable source of information is the earnings call transcripts of these "sentinel companies." Utilizing platforms like Koyfin, you can search for specific keywords or phrases across ALL earnings transcripts from all public companies.

I really don’t know how long back the archive goes, but it likely encompasses several years of historical data. By searching for these key phrases, you can identify turning points and market trend changes, using executive commentary as your primary source of insight.

Below, I've provided a list of key phrases you can use to identify these changes.

Conclusion: A More Astute Observer of the World

Well, this turned out to be a rather lengthy article. If you've made it this far, I hope it's now clear how the concept of sentinel species from ecology provides a powerful framework, or mental model, for identifying early indicators of market trends.

Just as canaries once alerted miners to invisible dangers, certain companies can serve as harbingers of broader economic shifts.4

Discovering relationships between the different parts of a sector or industry ecosystem can be as valuable as gaining profound insights from a company itself.

As you move forward in your investment journey, I encourage you to adopt this "ecosystem thinking" approach. Look for the interconnections between companies and sectors, identify potential sentinel indicators in your areas of interest, and remain vigilant for the subtle signals these companies may provide.

If you do this – you will not only become a better investor but a more astute observer of the intricate web of connections that drive our world.

Cerulean Warblers are highly selective in their breeding habitat, requiring large tracts of mature, structurally complex deciduous forests with tall canopies and abundant foliage. Their presence indicates a healthy forest ecosystem with diverse tree species, well-developed understories, and minimal disturbance.

Occupying the top of the freshwater food chain, river otters are exposed to a wide range of contaminants that may accumulate in their prey, such as fish and invertebrates. This bioaccumulation makes them particularly sensitive to pollutants in the water and their surrounding habitats.

Polar bears are considered a flagship species for Arctic conservation due to their unique position at the top of the Arctic food chain. The primary threat to polar bears is the loss of sea ice due to rising temperatures. As sea ice diminishes, polar bears face difficulties accessing their primary food source, seals. This leads to malnutrition, reduced reproductive success, and ultimately population decline. Monitoring polar bear populations and their body condition can therefore serve as a direct indicator of the extent and impacts of sea ice loss.

Lichens, a symbiotic organism composed of a fungus and an alga or cyanobacterium, are remarkably sensitive to air pollution. Their unique biology and lack of protective mechanisms make them excellent bioindicators of air quality and environmental health.Don't Miss the Signs: Identifying Companies with Predictive Power

The gold price is another sentinel. What could an all-time high in gold indicate for the economy, stocks, and commodities?