Early Signs That Show ‘This One’s About to Run’

A practical guide to inflection point investing in small-cap world: recognizing operational and market signals that precede explosive growth

Today’s article is about getting in before the big move.

My goal is simple: to identify companies just before they reach their inflection point, just when the early signals are appearing, but before the breakout is reflected in the quarterly financials.

These setups can be a powerful source of asymmetry. A historical example?

In late 2016, Vericel was an under the radar micro-cap, until a binary regulatory catalyst shifted its trajectory. The FDA’s approval of MACI in December 2016 unlocked a far larger and more scalable treatable population that needed knee cartilage repair.

For the first time, orthopedic surgeons had access to a regenerative option that was easier to use, more reproducible, and cleared for a broader range of patients, dramatically expanding its commercial potential.

Surgeon adoption accelerated as training programs rolled out, usage climbed year after year, and, of course, revenue followed. The results was that the stock re-rated sharply off its micro-cap base.

Vericel Corporation (VCEL) delivered a 1,744.5% return over 7.99 years, representing a 44.0% compound annual growth rate (CAGR) through the end of 2024..1

So today, I’ll look at the early indicators to identify companies that showed these exact signs before delivering explosive returns.

At the end, I’ll include a handpicked watchlist of small-caps I think could be right on the edge, complete with the lead indicators they’re showing right now and the catalysts that could flip the switch within one to three quarters.

What Do You Mean By Inflection Point?

To be clear, the definition of inflection point I’ll be using here refers to a turning point in product or service adoption. The goal is to recognize this shift in a company’s fundamentals before it shows up in the quarterly reports, and therefore before the market fully prices in the developing story.

The term inflection point comes from mathematics. Technically, it refers to the moment when, on a graph, the curvature of a curve changes sign—in simple terms, when the curve bends the other way.

In the context of investing, I’ll be using the term primarily to talk about product adoption. But I’ll extend the definition to include any major change that fundamentally transforms a company’s business, changes that typically precede an explosive period of growth.

So Where Are We Now?

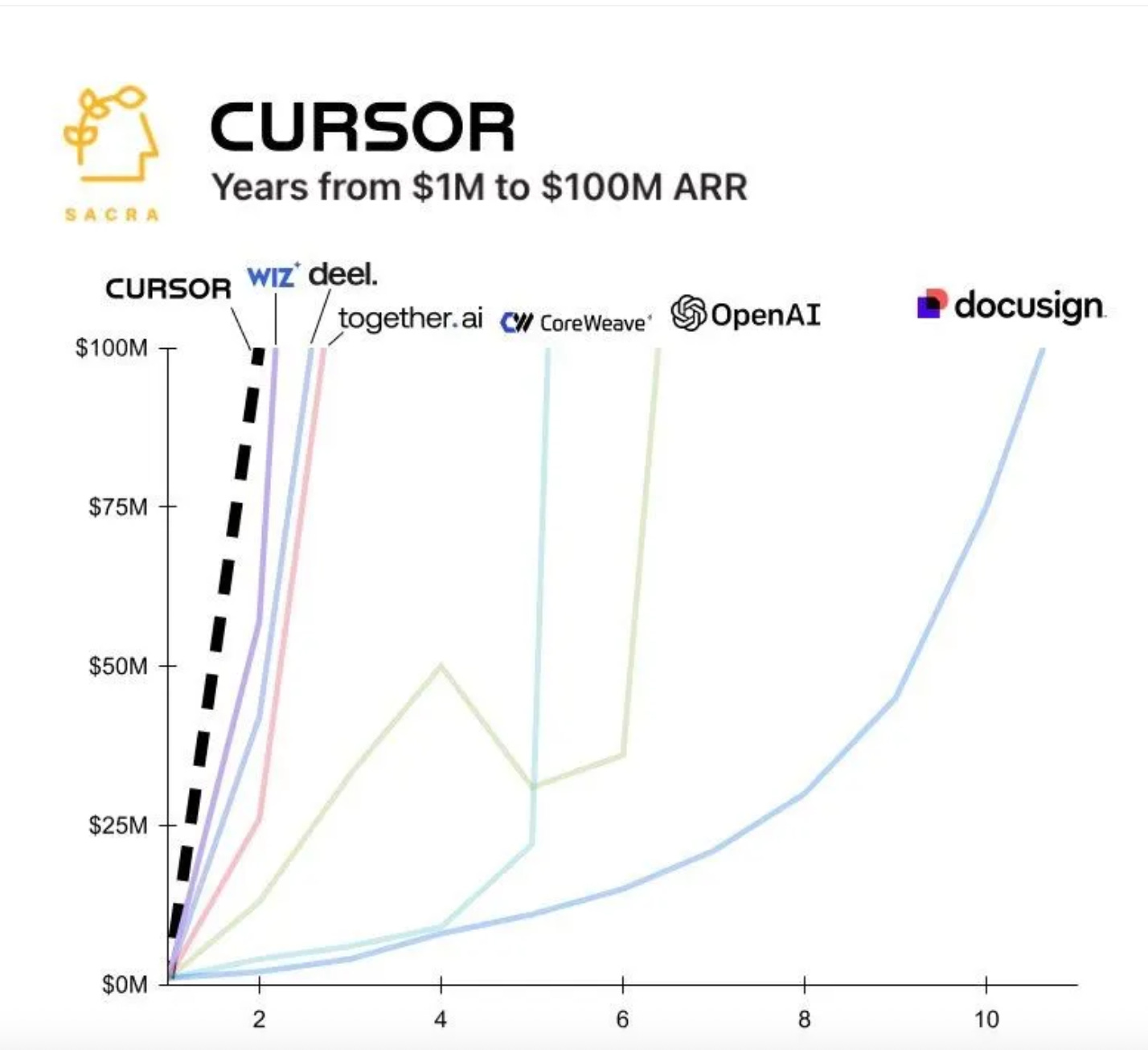

The telephone took 75 years to reach 50 million users worldwide. Today, Cursor hit $100 million in ARR in less than two years.

So what are the implications for investors? The potential payoffs are larger, as successful bets on companies at their inflection point can lead to outsized returns.

However, the window to identify these opportunities might be narrower, meaning we must recognize the signals earlier, act with greater conviction, and often commit before the broader market has validated the story.

Early Signals That An Inflection Point Is Near

“Developer adoption is the world’s leading indicator; revenue will follow”. - A Tech CEO (?)

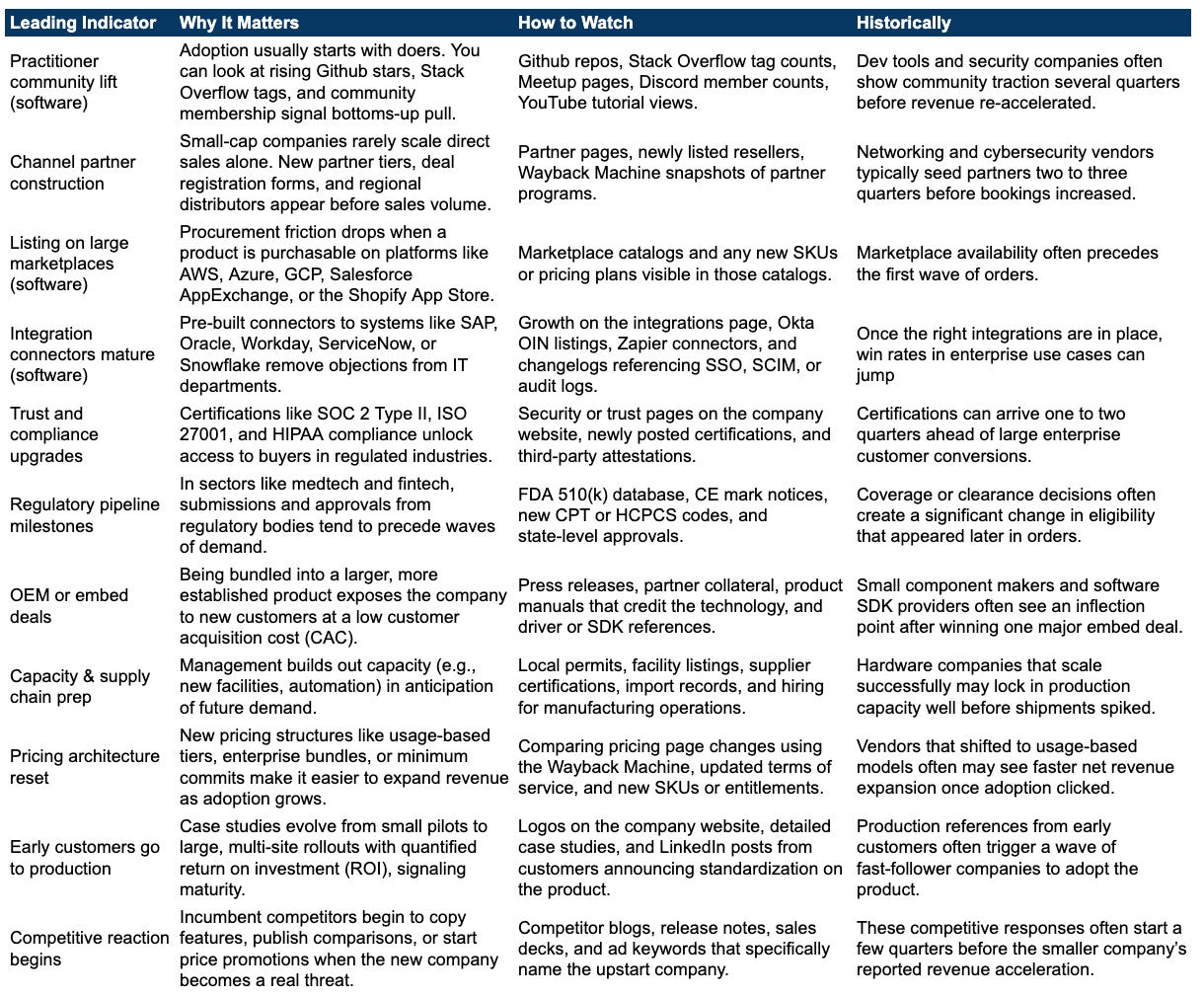

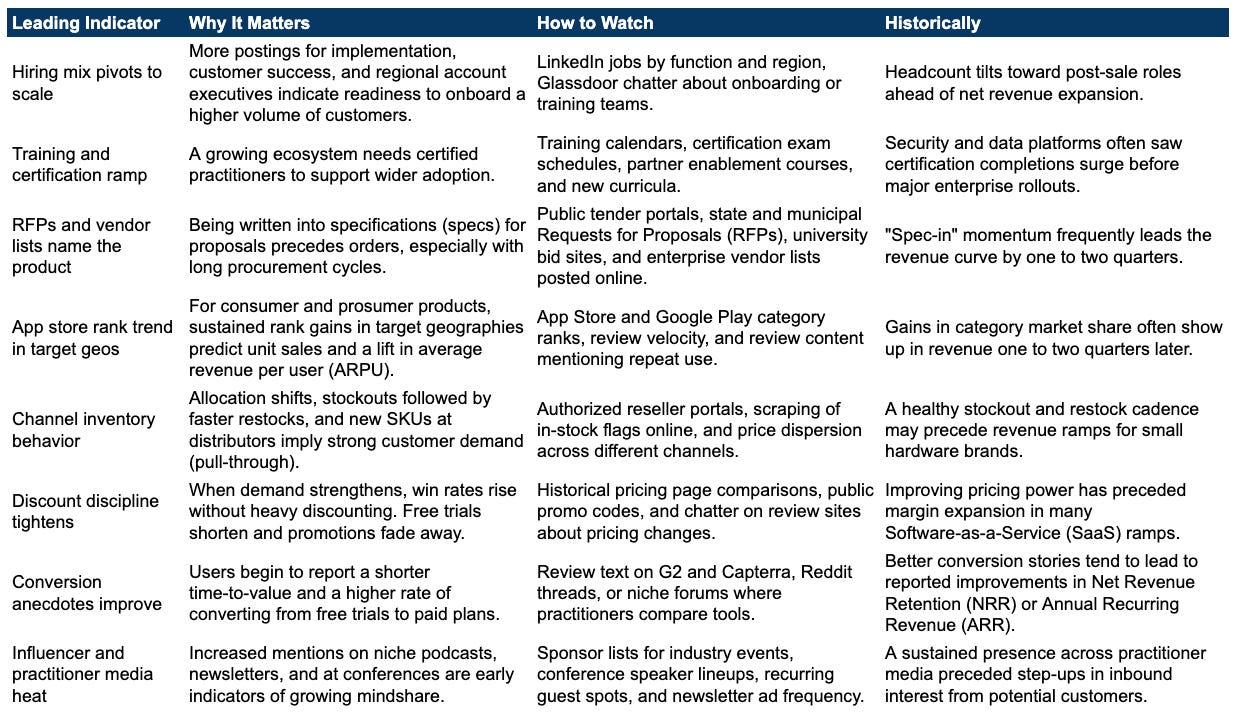

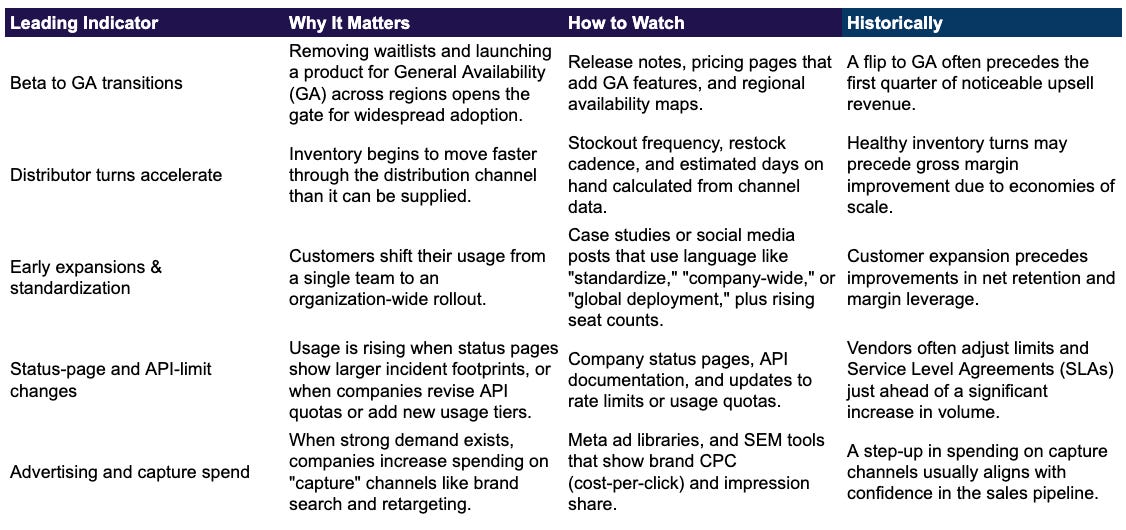

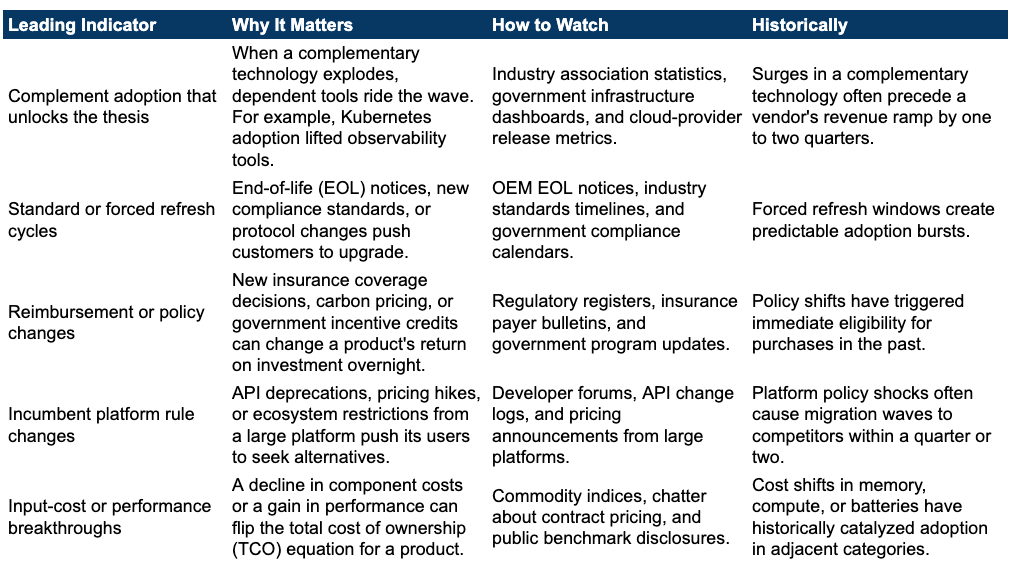

In the tables below, I put together some early indicators that can precede inflection points. I grouped them by lead time and mixed company-specific and industry-level triggers. While many apply primarily to software companies, others are equally relevant for businesses built around physical products.

For each item, you’ll see why it matters, how to track it without needing to subscribe to costly data, and a brief example of how it tends to play out.

Let’s begin.

6 to 12 Months Before The Surge

This is the gestation phase where you would see activity in communities swell, channel partnerships take shape, and infrastructure gets built to support scale. You might see developer forums with lots of activity, integration libraries expanding, and early compliance wins stacking up.

3 to 6 Months Before The Surge

Here the signals should start shifting from groundwork to momentum. Hiring would go to scale roles like customer success and regional account executives, training programs multiply, and the product begins showing up in RFPs, vendor lists, or app store rankings.

1 to 3 Months Before The Surge

In the closest phase you see operational signals (like heightened supplier activity, API limit changes, or expanded SLAs) and marketing shifts toward capture, with more retargeting and rising brand search share.

Market or Industry Level Triggers

Finally, market or industry-level triggers can act as external catalysts, compressing adoption timelines and amplifying a company’s trajectory.

These events often operate outside the firm’s direct control but can unlock or accelerate its thesis almost overnight.

9 Current Small-Cap Examples

So, which are the current examples of companies that match some of these markers? Below is a focused watchlist of publicly traded small caps that appear to be approaching an adoption inflection.

The goal of this exercise was to identify names where adoption could begin to show up in the fundamentals within the next one to three quarters.

Keep reading with a 7-day free trial

Subscribe to Polymath Investor to keep reading this post and get 7 days of free access to the full post archives.