Ondo InsurTech Plc (LON:ONDO): A Hardware-Enabled SaaS Company With Expanding ARR at a Strategic Inflection Point

Beyond proof of concept: Scalable recurring revenue, insurance industry validation, and a business model that funds its own growth

Dear Reader: In today’s article, I’m joined by Hugo Navarro from Undervalued and Undercovered. Together, we dive into an investment idea first featured in Hugo’s newsletter. If situations like this interest you, I highly recommend subscribing to his work.

Our focus today is Ondo InsurTech Plc (ONDO). With patented technology tackling a $20B problem in home insurance, blue-chip insurer partners already onboard, and a commercial model designed for rapid scale, Ondo is moving from proof of concept to proven growth. In this write-up, we’ll show why its candidate for a multi-fold upside and why now is the moment to pay attention.

If you haven’t yet, I also recommend checking out my last article on recognizing early inflection point signals. It serves as a great introduction to why Ondo is such a compelling setup. While this company is a bit different from those I usually cover here, I believe it represents an interesting situation with significant potential.

Let’s begin.

Summary

We believe Ondo InsurTech Plc (LON:ONDO) is one of the most interesting under-the-radar growth setups in public markets today.

One could argue that despite a recent rally, the company remains misunderstood and mispriced relative to its strategic value. Ondo has a patented solution tackling a $20 billion problem in home insurance, with blue-chip insurance partners already onboard. Its U.S. expansion, unique prepaid contract model, and repeat insurer orders point to accelerating growth that the market has yet to fully appreciate.

In our view, the current £~42 million enterprise value fails to reflect Ondo’s 80% recurring revenue growth and looming profitability. We see asymmetric upside: a potential multi-fold increase in equity value through a re-rating to peer multiples and continued execution, versus limited downside now that the model is validated and cash-funded.

In this short write-up, we detail why Ondo’s strategic position and economics merit a high-conviction investment, quantify upside with scenario analysis, benchmark valuation against peers.

Strategic Position & Product Differentiation

Ondo is pioneering claims prevention technology for home insurers, with a focus on water leak damage, a notoriously costly and prevalent problem. In the U.S. and UK alone, water damage causes $17 billion of home insurance claims annually, making it the single largest source of claims, getting more expensive every year, not only due to rising repair labor costs but also because of aging property infrastructure.

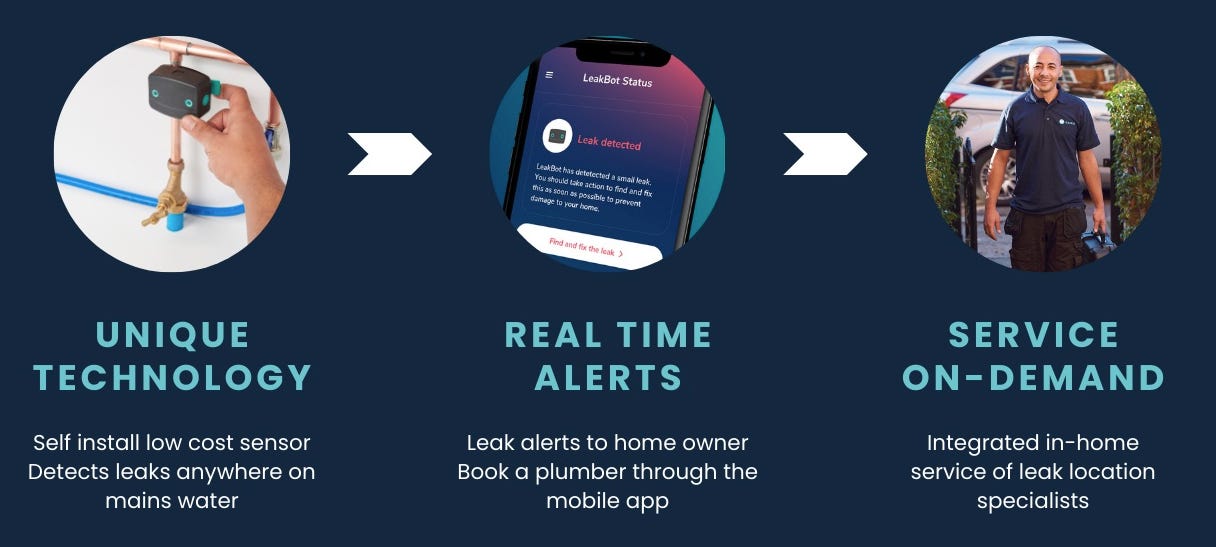

Ondo’s solution, the LeakBot device and service, directly addresses this pain point. LeakBot is a patented, IoT-enabled smart sensor that detects hidden water leaks without any professional installation, and connects homeowners to Ondo’s repair team for rapid fixes. This offering is one-of-a-kind globally, unlike piecemeal leak sensors, LeakBot provides whole-home monitoring from a single device and an integrated “find-and-fix” service, all at insurer scale.

Product Differentiation and ROI

No other competitor can detect micro-leaks (as small as 5ml/min) as LeakBot does using its patented Thermi-Q tech, nor offer a seamless repair solution at scale.

Importantly, insurers see a tangible financial benefit: early data from U.S. deployments show ~$2.4 million in claims avoided, delivering a 188% ROI to insurance partners. This means for every $1 an insurer spends on LeakBot, they save nearly $1.88 in claims, an attractive value proposition driving insurer adoption.

The device is self-installable in minutes by homeowners and so far shows high customer satisfaction (U.S. Net Promoter Score of +77 to +83 in pilots), reflecting the end-customer appeal.

In short, Ondo has cracked the code on proactive risk management for insurers: a simple IoT device + service that policyholders embrace and that slashes claim costs. This creates a powerful strategic position as insurers globally shift from reactive claims handling to proactive prevention.

U.S. Expansion and Prepaid Commercial Model

Ondo’s recent execution in the United States underscores its inflection from pilot stage to scaling growth. In the past year, Ondo expanded from operating in just 4 states to 25 U.S. states, making the U.S. now its largest and fastest-growing market.

Revenue from the U.S. grew exponentially year-on-year, accounting for 82% of the company’s overall revenue growth. Ondo has 9 U.S. insurance carriers signed on (3 of the top 20 nationwide), including industry giants like Liberty Mutual, Nationwide, and Hanover. Collectively these partners insure over 12 million homes, this is Ondo’s contracted customer base, which has ballooned to 14.6 million addressable households worldwide (80% in the U.S.).

Importantly, Ondo’s U.S. partners have quickly gone from initial trials to wider rollouts: According to management, “every major partner beyond their first deployment has expanded into more states or started to scale up their rollout”. For example, Nationwide’s program grew to 16 states, PURE to 15, and new regional insurers like Bear River Mutual have come on board post-year-end.

This traction demonstrates product-market fit in the U.S. and a clear runway for growth as insurers integrate LeakBot into their core offerings.

Prepaid Contract Model

Ondo’s business model further strengthens its growth trajectory. The company sells to insurers on a subscription basis (roughly ~$5 per device per month) but invoices a full year of fees upfront when an order is placed.

In practice, when an insurer agrees to deploy LeakBots, they prepay 12 months of service fees per device.

This prepaid contract model has two powerful effects:

(1) it funds Ondo’s working capital for manufacturing devices and servicing customers without requiring external financing, and

(2) it signals strong commitment from insurer partners (they have “skin in the game” from day one).

As management notes, this model has “significantly de-risked our working capital position”. With partners essentially financing the rollout, Ondo can scale faster with less balance sheet strain. Indeed, the company ended March 2025 with a comfortable £4.0m cash on hand after paying down legacy debt, and recently raised an additional £0.8m from warrant exercises.

Economics Improve With Scale

It’s worth highlighting that Ondo’s gross margins are designed to expand substantially in year two and beyond of each deployment cohort. In year one, the upfront device cost and installation services mean slim margins (single-digit percentage). But once a device is in place, years 2+ carry ~75–80% gross margins since ongoing monitoring and software have low cost.

As a result, the surge of U.S. deployments in the past year temporarily dampened reported margins, but as that installed base matures, profitability will inflect upward. Management expects EBITDA breakeven on a run-rate basis by the end of FY2026, an achievable goal given recurring revenue is compounding and operating costs are scaling modestly.

In short, Ondo’s U.S. expansion is building a high-margin annuity base that will drive operating leverage in coming years.

Insurer Traction and Evidence of Repeat Orders

Perhaps the strongest validation of Ondo’s model is the behavior of its insurance partners. Every single insurer that has piloted LeakBot has returned to place follow-on orders or expand deployments.

This 100% repeat order rate is extraordinary in the InsurTech/IoT arena, where many pilots fizzle out. It tells us two things:

(1) LeakBot is delivering real-world results for insurers (reduced claims, happy customers), and

(2) Ondo’s sales strategy of “land-and-expand” with small initial trials is working to open large rollout opportunities.

The company now has 25 insurance carriers as partners across Europe and North America, including household names such as Admiral and Direct Line in the UK, Hiscox internationally, and the aforementioned U.S. giants.

And let us tell you: these insurers are not in the business of buying gimmicks; they have rigorously tested LeakBot’s impact. The fact that, for example, Nationwide moved from a small pilot to offering LeakBot to up to 3 million of its customers as part of a smart home program speaks volumes about the solution’s efficacy.

Several data points illustrate the traction: In the last year, Ondo’s user base of registered LeakBot customers grew 59% to 151,000 (and exceeded 170k by June 2025). The company fixed over 6,000 leaks in FY2024/25, preventing an estimated 296 million liters of water waste and countless damage incidents, tangible proof of value to both insurers and society.

In the U.S. alone, 1,616 leaks were fixed, preventing $4+ million in would-be claims. Customer satisfaction remained stellar during this ramp (4.8 out of 5 CSAT) and Net Promoter Score climbed to +83, indicating that homeowners appreciate the service, a key factor for insurers considering broader rollout. This positive feedback loop (insurers save money and get happier customers) gives Ondo a strong flywheel for growth.

Each success story makes it easier to sign the next insurer or to push existing partners to accelerate deployments.

Notably, management reports that current insurance partners have only ~1% of their combined 14.6 million addressable homes penetrated so far. Even without adding a single new insurer, simply driving uptake within the existing contracts provides years of runway.

Many partners are now upping their targets, with initiatives like auto-shipping LeakBots to more policyholders to boost adoption. This evidence of increasing order sizes and multi-year rollouts underpins our conviction that Ondo’s growth is durable and less “one-off” than the market perceives. Far from a speculative concept, Ondo today is a scaling commercial business with recurring revenues and sticky B2B relationships.

Asymmetric Upside: Quantifying the Opportunity

At ~28p per share, Ondo’s market capitalization is only about £39 million (enterprise value ~£42 million). This values the company at roughly 6.8× its current annualized recurring revenue of £5.9m, a modest multiple given the 80% growth in recurring revenue last year and the high gross margins on mature cohorts.

By comparison, high-growth IoT SaaS companies often trade at 10–15× revenue (for example, Samsara trades around 14× sales).

Given Ondo’s profile of recurring subscription income, improving margins, and tangible TAM capture, a re-rate to, say, 10× ARR, would imply an enterprise value of ~£61m, about a 50% uplift from today before factoring any growth. But of course, we cannot base a thesis on multiple re-rating alone.

Future Earnings Power

The market appears to be extrapolating Ondo’s small FY2025 revenue (£3.9m) rather than looking at its contracted pipeline and trajectory. Annualized contracted recurring revenue is already £5.9m and growing, and as deployments compound we anticipate revenue will scale geometrically. Consider a few credible scenarios:

Base case: Assume Ondo continues its current momentum and deploys ~120k new LeakBot devices per year (in line with recent uptake). By FY2028, it would have on the order of 500,000 total devices in the field. At £45–50 annual revenue per device ($5/month), that equates to ~£22–25 million ARR. Even applying a moderate 20× EBIT exit multiple (for a profitable, growing SaaS/IoT firm) and accounting for operating costs, the equity value would be on the order of £150 million. That is ~5× today’s market cap, an attractive outcome in 3 years for a “base” expectation.

Bull case: If adoption accelerates with mass-market success (akin to how a comparable fire-prevention sensor, Ting, scaled from 100k to 1 million homes in four years), Ondo could feasibly deploy ~300k devices per year as manufacturing capacity allows. In a bullish scenario of ~1 million devices deployed by FY2028, Ondo’s model projects around £22 million in EBIT, which at a 25× multiple yields a market cap of ~£548 million. That is roughly 16× the current valuation, truly asymmetric upside. Management themselves speak of ambitions to build a “billion-dollar” company on the back of the U.S. opportunity, and our analysis suggests this is not fanciful if even a single-digit percentage of U.S. insured homes ultimately adopt LeakBot.

Downside view: In a bear case where expansion stalls, growth slows dramatically, or only the current contracted deployments play out, Ondo would still likely reach breakeven and sustain a business on its existing base. The fixed cost structure is reasonable (FY2025 op ex ~£5.3m) and can be adjusted if needed. Even under very slow uptake (e.g. 50k devices/year) the company’s own model shows it would achieve EBIT breakeven within a few years. That implies the downside is largely time-value and not permanent capital impairment, in a worst case Ondo might tread water or require a dilutive financing to bridge a longer runway, but the technology and contracts in hand provide an intrinsic floor of value. In our view, the market’s pricing already reflects a degree of skepticism close to a bear case, while assigning minimal probability to the much more evident base/bull outcomes.

In summary, the risk/reward skew is really favourable. Our base and bull scenarios suggest 5× to 10×+ upside in the next 3-5 years with execution, whereas the fundamental downside is limited by a growing recurring revenue base and a cash-light model. If everything plays out as planned, an investment at today’s prices could yield a 50%+ IRR under our growth assumptions.

Relative Valuation: Peers and Precedents

To further underscore Ondo’s undervaluation, consider its standing against relevant peer groups:

InsurTech peers: Many publicly listed insurtech companies (e.g. Lemonade, Hippo) pursued full-stack insurance underwriting, which led to heavy losses and investor fatigue. Ondo is a different animal, it’s a pick-and-shovel model selling to insurers, not taking underwriting risk. Yet even the struggling insurtechs often trade at a few times revenue. Lemonade, for instance, with ~20-30% growth, has traded around 3-4× forward revenue in recent times. Ondo at ~6-7× run-rate revenue might appear higher, but remember its gross margins and growth are superior. Moreover, if Ondo executes, it could become an acquisition target for an insurer or IoT conglomerate looking to own this capability.

IoT/Subscription tech peers: Ondo’s profile (hardware-enabled SaaS with recurring fees) is perhaps better compared to IoT platform companies. Samsara (NYSE:IOT), which offers IoT fleet monitoring, trades at roughly 16× sales with ~30% growth. Alarm.com, a mature connected home security platform, trades around 5× sales but at steady profitability. High-growth IoT or safety tech firms can command >10× revenue multiples, especially when they have a clear path to profitability. Ondo’s current ~£42m EV for what could be a globally scalable, category-leading IoT solution looks exceedingly small. Even private market comps are instructive: venture-funded smart home device startups with far less traction have been valued at similar or higher levels. Ondo, however, has proven adoption and revenue, a fact the market has not caught up to.

Claims prevention & risk mitigation: There are few pure-play public comps in claims prevention tech, because it’s a nascent field. One analogous success story is Whisker Labs’ Ting (fire hazard sensors sold via insurers). Ting is private, but it raised substantial capital and scaled to over 1 million installations in partnership with insurers like State Farm. The takeaway is that large insurers are willing to back and deploy effective risk-reduction tech rapidly when the economics make sense. Ondo is on the cusp of similar scale in water damage. If it were a U.S. high-growth SaaS, with its current customer logos and growth, it’s not a stretch to think Ondo could support a double-digit revenue multiple. Thus, relative to any peer framework, be it insurtech, IoT SaaS, or industrial tech, Ondo appears undervalued.

Why Now?

We assert that the timing for this investment is uniquely favorable. Ondo’s story has transitioned from speculative to proven in the last 12-18 months, yet the stock’s re-rating is lagging this reality. A year ago, investors doubted whether U.S. insurers would embrace this UK micro-cap’s gadget; now, Ondo has three Top-20 US carriers live and counting. The company has moved “beyond proof of concept into proven, scalable growth” with the U.S. as the driving force. We are at the inflection point where commercial validation is clear but broader market recognition is not.

Several factors make the opportunity time-sensitive:

Imminent catalysts: We foresee multiple potential catalysts in the next 6-12 months. Ondo’s management is actively pursuing new insurer partnerships (e.g. a recent distribution deal with VIP HomeLink was announced to widen U.S. reach). Each new contract (especially if a major U.S. carrier like a State Farm or Allstate were to sign on) could be game-changing for sentiment. Likewise, further expansions of existing deals (Nationwide moving from 16 states toward nationwide coverage, Liberty Mutual scaling up, etc.) are very plausible given the repeat order pattern. Positive news on this front could re-rate the stock quickly.

Financial inflection: As discussed, Ondo is on track to reach EBITDA-breakeven within the next ~12-18 months. The market is often skeptical of micro-cap techs until they prove they can reach profitability without constant dilution. Ondo is about to clear that hurdle, its cash balance and prepaid revenue model give it sufficient runway to get there without a dilutive equity raise (although this is one of the risks, management project adequate resources through at least July 2026 under current plans). Essentially, we see a window of opportunity before Ondo graduates from “story stock” to a small-cap growth stalwart.

Market conditions and sentiment: It’s no secret that 2022–2023 were tough years for early-stage tech stocks, with many investors fleeing risk. Ondo, being AIM-listed and sub-£50m market cap, has been off most institutional radar screens. However, as performance comes through, we anticipate increased and buying interest.

Technology leadership is up for grabs now: The concept of “predict and prevent” in insurance is reaching a tipping point. Major insurers (like Nationwide) are now openly embracing these solutions, which creates urgency for others to follow suit or be left behind. Ondo is one of the few proven providers in this space (competitors have fallen by the wayside or are far behind in real deployments). We suspect the next 6-12 months will see a land-grab as insurers allocate budgets to risk prevention technology. Investing in Ondo now aligns with this industry cycle, effectively getting in on the ground floor of a secular shift in insurance. Six or twelve months from now, if Ondo’s devices are deployed by, say, 5 of the top 20 U.S. insurers instead of 3, the narrative will shift from “experimental gadget” to “standard toolkit for home insurance”.

If you want more details about their competitive position, as well as management’s answers on dilution and other key questions, we recommend watching the following interview Hugo conducted with the team:

Risks

We would be remiss not to acknowledge the risks. This is a small, pre-profit, single-product company embarking on aggressive international expansion. So, eyes wide open—there are risks, and they are not minor. Below is a list of the most significant ones:

Upfront subsidization & margin risk: Ondo’s model involves giving away or heavily discounting devices to secure subscription contracts, front-loading costs and relying on multi-year customer retention to make unit economics positive. If adoption stalls, churn rises, or Year-2+ revenues fail to materialize, the business could remain stuck in low-margin territory.

Short cash runway & dilution risk: Despite a £3m raise in mid-2024, there’s the possibility of another raise before breakeven if they don’t reach break even, as management expects, before May 2026.

Execution & operational complexity: Rapid U.S. expansion from 4 to 25 states strains a small team, requiring nationwide coordination of third-party contractors for repairs, raising service quality and scalability risks.

Single-product dependency & competition: Entirely reliant on LeakBot, a patent-protected but not inimitable water leak sensor, facing competition from larger players with multi-function smart-home solutions that insurers may prefer.

Governance red flags: Low insider ownership and a PR consultant (founder of the PR/IR firm that Ondo employs for investor communications) serving as a board member may raise questions about independence and focus on promotion over oversight.

Competitive partner dynamics: Even key insurer partners like Liberty Mutual and Nationwide are pursuing multiple insurtech initiatives, making it possible LeakBot remains a niche tool rather than a standard.

Debt overhang & high interest: £7.07m owed to HomeServe at 12–14% interest creates a long-term burden, with compounding interest likely exceeding £10m before repayments begin in 2027, diverting future profits.

Constrained funding options: HomeServe’s dual role as major shareholder and creditor introduces potential conflicts; warrant proceeds are limited, and future funding may require deeply dilutive equity or costly debt.

Conclusion

In conclusion, we see Ondo InsurTech as a misunderstood inflection point situation with a large untapped market, unique product with moat (patents + data + service network), a scalable commercial model, accelerating revenue with expanding margins, and an under-the-radar stock due to its micro-cap status and lagging perception.

This is a classic case of asymmetric upside , where our downside is cushioned by tangible contracts and recurring revenues, while the upside could be transformational.

We are cognizant that no investment is without risk: Ondo is still relatively small and execution in converting insurer commitments to mass deployment will be key. However, the evidence to date (100% partner retention/expansion, enthusiastic end-customers, and the insurer ROI) gives us confidence that execution risk is diminishing quarter by quarter.

The market’s skepticism, in our view, is rooted in outdated analogies to failed insurtechs or IoT gadgets that didn’t scale. Ondo is proving those skeptics wrong, and we aim to capitalize on that misperception.

Our forecasts suggests that base-case success could yield a 5x return in a few years, with bull case upside into the 10-15x+ range. Few opportunities in public markets offer that kind of return potential with this level of validation already in hand.

In sum, Ondo InsurTech Plc represents a compelling asymmetric bet: a misunderstood leader in a new category, poised for a re-rating as it converts pipeline to profits.

If you're interested in learning more about the company, we recommend watching their latest full-year results presentation or reading Hugo’s deep dive:

Hello, really nice article. I think the ideas around inflecting point you point out are on point (sry).

Following the inflecting point idea I think you would like to see https://open.substack.com/pub/jjinvestmentclub/p/moatable-mtbly-investment-thesis?utm_source=share&utm_medium=android&r=30rt07

Even though the recent run up and the huge dividend, it is still a very good oportunity.

Regards!

Interesting that the device was first cooked up by Greg Jackson on a RPi, who went on to found Octopus.

https://www.share-talk.com/peter-thiels-7-questionsand-why-i-think-ondo-could-be-a-billion-dollar-company/