The Glacial Advance: Investing in the Inevitable Tides of Demographic Change

Recognizing and planning for the inevitable trends shaping our world

In 2020, for the first time in human history, the number of people on Earth aged 60 and older surpassed the number of children younger than five.1

This was the cresting of a demographic wave that has been building for decades and a trend that I’ve been looking for a while now. Like a glacier, you don’t notice its movement from one day to the next, but over time, it reshapes the world beneath it.

That single statistic is a marker for one of two colossal, locked-in transformations that will define the 21st-century global economy: the profound and rapid aging of the world’s population.

The other transformation? A concurrent force of equal magnitude: the relentless migration of humanity into sprawling urban centers.

In today’s article I echo Jared Diamond’s core idea in Guns, Germs, and Steel:2 that framework that long-run outcomes are shaped less by proximate events and more by slow, structural forces that set the boundaries of what is possible.

So for us, as investors, the challenge (and the opportunity) lies in looking beyond short-term market gyrations to focus on the inevitable tides of demographic change.

Let’s begin.

Charting the Two Great Demographic Reshuffles

Before seeking opportunities in specific companies or sectors, let’s try to understand the sheer scale of the forces at play. These demographic shifts are the new foundational laws of physics governing global growth, labor, and capital for the next generation. Understanding their magnitude, velocity, and interaction is the foundation of any durable long-term investment strategy.

The Silvering of the Globe

The world is getting older, faster than ever before. And this not a forecast subject to debate, this is a mathematical certainty.

The trend is the result of decades of falling fertility rates and remarkable gains in longevity.3 Between 2015 and 2050, the proportion of the global population over 60 is set to nearly double, climbing from 12% to 22%.4

The most extreme changes though, are happening at the upper end of the age spectrum. The number of individuals aged 80 or older is projected to triple between 2020 and 2050, reaching 426 million.5 This is exponential acceleration. So, as investors, we should ask ourselves: what are the implications of this massive change?

A common misconception is that this "silver tsunami" is exclusively a problem for wealthy, developed nations. While countries like Japan, where 30% of the population is already over 60, are the current poster children for this trend, the demographic center of gravity is shifting quiet substantially. The pace of aging is now fastest in low- and middle-income countries.

By 2050, two-thirds of the world's elderly will live in these developing nations, up from just over half today.

Researchers are calling this worldwide shift “The Great Inversion”, and for good reason. Let’s see why.

“The Great Inversion”

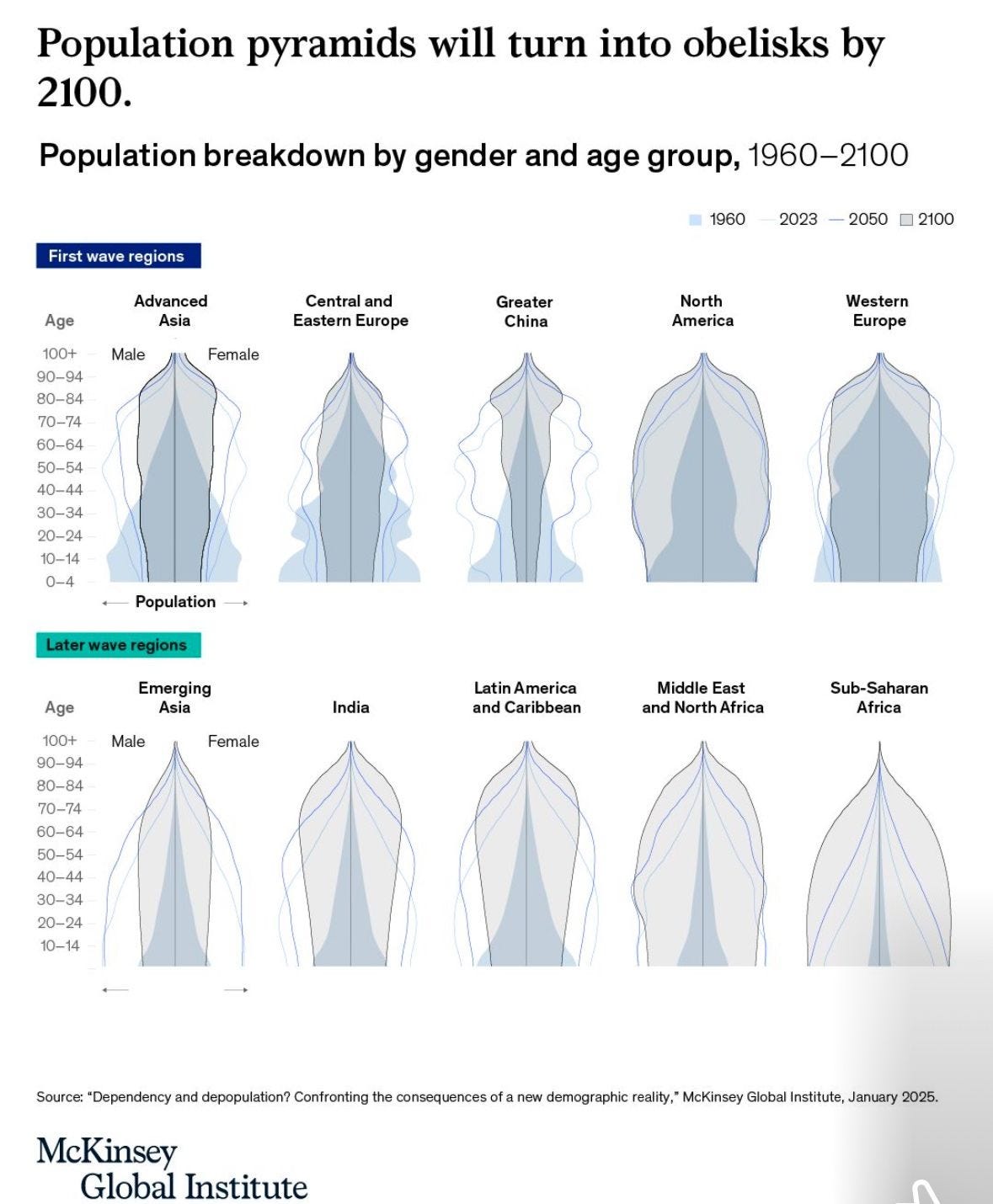

For all of modern history, societies have been structured like a pyramid, with a broad base of young workers supporting a narrow peak of retirees. Now, this structure is flipping on its head, transforming into "obelisks" with a shrinking base of young people and a bulging top of older dependents.

This tendency represents a fundamental rewiring of the social and economic calculus that has underpinned global growth for centuries.

Let’s think about it for a minute: systems built on the assumption of a pyramid structure (pension funds, healthcare financing, labor force growth, and intergenerational wealth transfers) are mathematically incompatible with an obelisk.

This structural mismatch is the source of immense economic strain, could also be the wellspring of immense investment opportunity?

What about the other colossal change?

Billions on the Move: Humanity’s Rush to the Cities

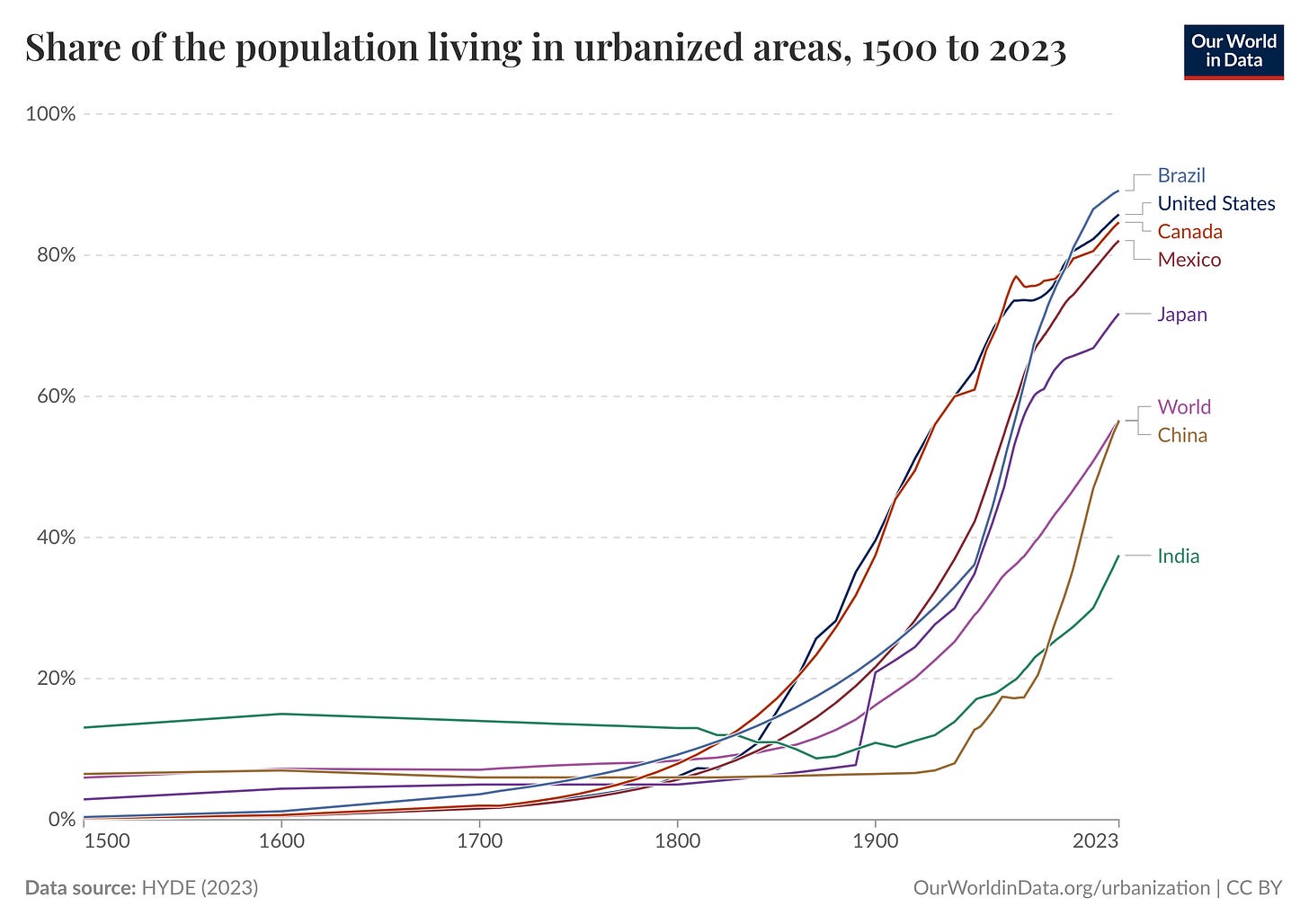

Running parallel to the aging of the globe is a second, equally powerful human migration: the mass movement into cities.

Today, 58% of the world’s 8 billion people live in urban areas. By 2050, the United Nations projects this figure will climb to 70%.6 This shift, combined with overall population growth, means that cities will need to accommodate another 2.5 billion people over the next quarter-century.7

This is a historic flood of humanity that demands an unprecedented level of capital investment in housing, transport, energy, and services.

Like the aging trend, this wave of urbanization is not uniform. It is overwhelmingly concentrated in the world's youngest and fastest-growing regions.

Nearly 90% of this 2.5 billion-person increase will occur in Asia and Africa.8 The scale of this concentration is best understood at the country level. Between 2018 and 2050, just three nations; India, China, and Nigeria. are projected to account for over a third of all new urban dwellers globally. India is forecast to add 416 million people to its cities, China 255 million, and Nigeria 189 million.9

This creates a fascinating contrast. While the world’s oldest regions, such as parts of Europe and Japan, are seeing some cities shrink, the world’s youngest continents are experiencing hyper-urbanization.10

We are now in a “Two-Speed” World.

The Dynamics of a "Two-Speed" World Engine

One part of the world, composed largely of developed nations, is aging, trying to cope with shrinking workforces, and desperately seeking productivity gains to maintain living standards (yes, and here AI might just be the dark horse).

The other part, primarily in emerging markets, is young, rapidly urbanizing, and focused on the monumental task of building basic infrastructure and trying to meet the aspirations of a new, rising consumer class.

One would think that these are two separate stories but they are actually two sides of the same coin: the aging world needs the growth, labor, and new markets of the young, urbanizing world to sustain its economic vitality. The young, urbanizing world needs the capital, technology, and expertise of the old world to build its future.

This deep, symbiotic interdependence will be a primary driver of global capital flows, supply chains, and corporate strategy for decades to come.

The End of Easy Growth?

The inversion of the population pyramid acts as a structural drag on growth, creating what McKinsey calls a new reality of "dependency and depopulation".11 The core metric to understand here is the support ratio: the number of working-age people (ages 15-64) available to support each person over 65.

Globally, this ratio is in free fall. Having stood at 9.4 in 1997, it has already declined to 6.5 today. By 2050, it is projected to plummet to just 3.9.

As you can anticipate, this demographic drag translates directly into a headwind for economic growth.

The simple formula for GDP growth is the sum of growth in the labor force and growth in labor productivity. When the first component (the number of workers) is flat or shrinks, the entire hope of growth falls on the second.

Without a dramatic acceleration in productivity (again, AI?), economic expansion will inevitably slow.

The conventional wisdom, largely shaped by Japan's experience after its 1990s asset bubble burst, holds that aging is deflationary.12 But is it?

A shrinking population and workforce lead to flat demand and falling prices. However, looking more closely a new and compelling argument says the opposite may be true for the rest of the world.

As large cohorts of retirees stop producing goods and services but continue consuming (supported by savings and government transfers) they add to aggregate demand without adding to aggregate supply. Simultaneously, a shrinking pool of available workers gives labor more bargaining power, pushing up wages.

This combination of steady demand and constrained supply is a classic recipe for inflation.

There’s a very interesting BlackRock report that argues that this dynamic could force central banks to maintain interest rates at a structurally higher level than the market has grown accustomed to over the past four decades.13 Again let’s think about the implications for investors: not only the effect of higher interest rates but also the fact that governments will have to endure higher debt servicing costs at a time of slowing tax revenues.14

The multi-decade tailwind of falling interest rates, which lifted the value of nearly all financial assets, may just be over. In its place, a new regime of higher inflation and higher nominal rates would mean that future returns will depend far more on the specific execution and pricing power of individual companies and far less on a perpetually falling discount rate.

As Buffett often says, the best businesses in an inflationary environment are those that can raise prices without losing customers, because when money’s worth less, the ability to pass higher costs through to buyers is what really keeps the profits going.

Following the Predictable Currents of Global Demand

Now, for the long-term investor a good practice would be to identify the specific industries and business models best positioned to capture this predictable, multi-decade flow of demand.

Let’s see which would those be for these two mega trends.

The "Silver Economy"

The "Silver Economy" (the sum of all economic activity catering to the needs and wants of older adults) is one of the largest and most reliable growth markets in the world.

While estimates vary, credible market forecasts value the global Silver Economy at over $5.5 trillion in 2023, with projections for the early 2030s ranging from $8.5 trillion to $27 trillion.15

The first-order investment implications are clear and have been for some time. This is the "Longevity-as-a-Service" (LaaS) stack, encompassing the goods and services directly consumed by an older population.

The primary segments include:

Healthcare: This is the most obvious beneficiary, with rising demand for pharmaceuticals to treat age-related conditions, medical devices, telehealth platforms that enable remote monitoring, and, critically, home healthcare services.

Housing and Assistive Technology: As 90% of seniors wish to age in their own homes, there is a massive market for home modification services, mobility aids like walkers and scooters, and smart-home technologies for monitoring and safety.16 Savaria Corporation (SIS) is an interesting one.

Now, this is just a purely first-order analysis and misses a deeper dynamic. A simple forecast assumes that as Baby Boomers retire with trillions of dollars in accumulated wealth, they will spend it freely. Yet, a wealth of psychological and behavioral research is revealing an interesting and surprising bias: the "decumulation paradox."

The “Decumulation Paradox”

Retirees, even affluent ones, are apparently intensely reluctant to spend down their principal savings.17 Studies are consistently showing that many retirees live only on Social Security and investment income, leaving their nest egg untouched.

One study found that after nearly two decades in retirement, the median retiree still has 80% of their pre-retirement savings.18

Why is this happening then? There are powerful psychological forces behind, but mostly is due to loss aversion (the pain of seeing a portfolio balance decline) and a deep-seated fear of uncertain future costs, especially for long-term healthcare.

The key takeaway here is that retirees whose income is guaranteed (from sources like pensions or annuities) spend significantly more freely and report higher levels of satisfaction.19

This reveals the true second-order opportunity: a vast and growing market for products and services that provide financial and psychological certainty. The most valuable product is not another vacation package, but the permission to spend.

Which companies can provide this? Think traditional annuity providers, but also a new generation of fintech companies.

Let’s review now which industries are being favoured by the urbanization mega-trend.

Paving the Future: Picks and Shovels for a $94 Trillion Build-Out

The migration of 2.5 billion people into cities by 2050 necessitates the largest and most complex infrastructure build-out in human history. This mandate creates a multi-decade, non-discretionary demand cycle for a specific set of industries.

The numbers involved are almost incomprehensibly large. The G20's Global Infrastructure Hub (GI Hub) forecasts a global need for $94 trillion in infrastructure investment by 2040.20

This spending is heavily concentrated in the sectors that form the base of urban life. Consider that roads and electricity alone account for the majority of the investment.

Layered on top of this baseline demand is the global energy transition. The shift toward electrification and renewables requires a wholesale re-engineering of the power grid.

Global electricity generation capacity is projected to need a 165% increase by 2050, with nearly two-thirds of that driven by the pivot to renewables, which have different infrastructure requirements than traditional thermal power.21 This definitely creates a clear roadmap for identifying the "picks and shovels" of 21st-century urbanization. Let’s see:

Energy Infrastructure: Companies specializing in renewable power generation (solar, wind), grid modernization and energy storage solutions, and the transmission infrastructure needed to connect them. Companies like Tantalus Systems Holding Inc. (GRID) could be beneficiary of this trend.

Sustainable Mobility: Firms involved in building and operating public transit systems, manufacturing electric vehicles and their components, developing EV charging networks, and creating the logistics systems that enable commerce in dense environments. Companies like NFI Group Inc. (NFI) in this case may also benefit from this trend.

Digital Infrastructure: As cities grow, they must become "smarter" to remain functional. This creates a vast market for companies providing the Internet of Things (IoT) sensors, data analytics platforms, and high-speed connectivity (like 5G) that allow cities to optimize everything from traffic flow and waste collection to energy use and public safety. Companies like Ondo InsurTech Plc (ONDO) may benefit from this as well.

Now, let’s pull it all together and frame it as thematic baskets.

High-Conviction Thematic Baskets

This framework does not recommend individual securities but rather identifies investable thematic "baskets." As investor we can use these baskets as a starting point for researching companies aligned with these powerful secular tailwinds.

Having these mental models in mind when evaluating companies can be a pretty good filter. They help us identify business models with the wind at their backs and spot when a seemingly small innovation is actually tapping into a massive, slow-moving force. Next week, I’ll publish an investment write-up on a company that I believe sits at the crossroads of one of these trends.

The Enduring Edge of a Long-Term View

The demographic shifts of global aging and mass urbanization are deep and predictable currents flowing beneath the surface. They are the glacial advance, reshaping the economic landscape with an unstoppable force.

While predicting market moves can be a fool’s errand, forecasting the broad shape of the demand these trends will create is a worthwhile exercise for investors.

The enduring edge then, may not come from outsmarting the market tomorrow, but from being more patient over the next decades; anchoring our investment decisions to the profound, inevitable, and powerful transformation of the human landscape.

Disclaimer

This newsletter (the “Publication”) is provided solely for informational and educational purposes and does not constitute an offer, solicitation, or recommendation to buy, sell, or hold any security or other financial instrument, nor should it be interpreted as legal, tax, accounting, or investment advice. Readers should perform their own independent research and consult with qualified professionals before making any financial decisions. The information herein is derived from sources believed to be reliable but is not guaranteed to be accurate, complete, or current, and it may be subject to change without notice. Any forward-looking statements or projections are inherently uncertain and may differ materially from actual results due to various risks and uncertainties. Investing involves significant risk, including the potential loss of principal, and past performance is not indicative of future results. The author(s) may hold or acquire positions in the securities or instruments discussed and may buy or sell such positions at any time without notice. The views expressed are those of the author(s) and are subject to change without notice. Neither the author(s) nor the publisher, affiliates, directors, officers, employees, or agents shall be liable for any direct, indirect, incidental, consequential, or punitive damages arising from the use of, or reliance on, this Publication.

World Health Organization. (2020). UN Decade of Healthy Ageing: Plan of Action (2021–2030). https://cdn.who.int/media/docs/default-source/decade-of-healthy-ageing/decade-proposal-final-apr2020-en.pdf

Diamond, J. (1997). Guns, germs, and steel: The fates of human societies. W. W. Norton & Company.

Ageing - United Nations Population Fund, accessed August 3, 2025, https://www.unfpa.org/ageing

World Health Organization. (2020). UN Decade of Healthy Ageing: Plan of Action (2021–2030). https://cdn.who.int/media/docs/default-source/decade-of-healthy-ageing/decade-proposal-final-apr2020-en.pdf

World Health Organization. (2020). UN Decade of Healthy Ageing: Plan of Action (2021–2030). https://cdn.who.int/media/docs/default-source/decade-of-healthy-ageing/decade-proposal-final-apr2020-en.pdf

United Nations. (2023). The Sustainable Development Goals Report 2023. United Nations Statistics Division. https://unstats.un.org/sdgs/report/2023/goal-11/

United Nations. (2023). The Sustainable Development Goals Report 2023. United Nations Statistics Division. https://unstats.un.org/sdgs/report/2023/goal-11/

United Nations, Department of EconoWorld Urbanization Prospects 2024. https://population.un.org/wup/

United Nations, Department of EconoWorld Urbanization Prospects 2024. https://population.un.org/wup/

OECD, African Development Bank, Cities Alliance, & United Cities and Local Governments of Africa. (2025). Africa’s Urbanisation Dynamics 2025: Planning for Urban Expansion. https://www.oecd.org/publications/africa-s-urbanisation-dynamics-2025_005a8aa0-en.htm

Confronting the consequences of a new demographic reality ..., accessed August 3, 2025, https://www.mckinsey.com/mgi/our-research/dependency-and-depopulation-confronting-the-consequences-of-a-new-demographic-reality

Demographic divergence | BlackRock Investment Institute, accessed August 3, 2025, https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/mega-forces/demographic-divergence

Demographic divergence | BlackRock Investment Institute, accessed August 3, 2025, https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/mega-forces/demographic-divergence

Demographic divergence | BlackRock Investment Institute, accessed August 3, 2025, https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/mega-forces/demographic-divergence

Silver Economy Market Report | Global Forecast From 2025 To 2033 - Dataintelo, accessed August 3, 2025, https://dataintelo.com/report/global-silver-economy-market

Silver Economy Market Size, Share, Trends & Forecast, accessed August 3, 2025, https://www.verifiedmarketresearch.com/product/silver-economy-market/

Taylor, T., & Faou, K. (2024). Understanding underspending in retirement: The decumulation paradox [White paper]. New York Life Annuities. https://www.nylannuities.com/connectedassets/final-assets/marketing-materials/white-paper/TPD_Client_Whitepaper_Decumulation_paradox.pdf

The Psychological Side of Spending Your Retirement Savings, accessed August 3, 2025, https://www.firsttechfed.com/articles/invest/the-psychological-side-of-spending-your-retirement-savings

Gale, W. G., & Saltzman, E. (2019). How retirement income sources affect spending. Urban Institute. https://www.urban.org/sites/default/files/publication/100858/how-retirement-income-sources-affect-spending_1.pdf

Global Infrastructure Hub. (2025). Global infrastructure investment outlook and gap analysis. Retrieved August 8, 2025, from https://www.gihub.org

How large are global infrastructure needs? - Aberdeen Investments, accessed August 3, 2025, https://www.aberdeeninvestments.com/en-us/investor/insights-and-research/how-large-are-global-infrastructure-needs-us

One thing to consider: India, Indonesia, Mexico, and Saudi Arabia are all below replacement rate.